ERC-721, Memecoin, FOMO

ERC-721, Memecoin, FOMO

Rise of the “Hype Train”: Understanding Cryptocurrency and NFTs

In recent years, the value of cryptocurrencies has skyrocketed, with some assets achieving returns of over 1,000%. One of the main drivers of this phenomenon is the rapidly growing community of investors, collectors, and enthusiasts known as “Hodlers.” Among these collectors, there are two specific collections that have gained significant traction: Crypto and ERC-721.

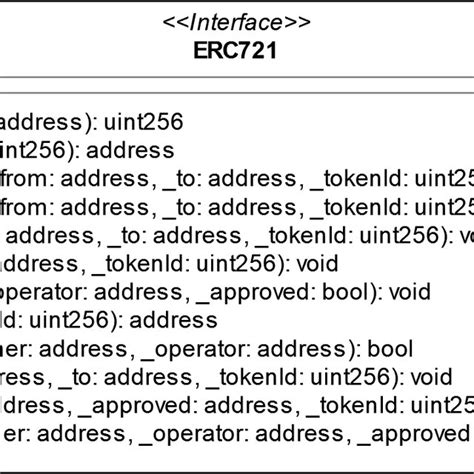

ERC-721: The Standard for NFTs

The Ethereum-based cryptocurrency, often referred to as “the standard” or “the blueprint,” has played a key role in shaping the world of non-fungible tokens (NFTs). ERC-721, the first and most widely used standard for creating and trading digital collectibles, was introduced by Ethereum developer Vitalik Buterin. This token allows creators to mint, store, and transfer unique digital assets, such as art, collectibles, and even in-game items.

ERC-721 tokens have become highly sought after by collectors due to their rarity, rarity, and unique ownership that comes with them. NFTs (Non-Fungible Tokens) are essentially unique digital assets that cannot be exchanged for another asset of the same type or value.

The Rise of Memecoin: From Speculation to Phenomenon

Meanwhile, another cryptocurrency has emerged as a major player in the collectibles world: memeCoin. Launched in 2017, memeCoin is often referred to as “Meme” due to its association with internet culture and memes. However, its rarity, novelty, and the speculation surrounding its price have quickly made it a popular choice among collectors.

MemeCoin’s market cap has skyrocketed over the years, with prices reaching unprecedented heights in recent months. This phenomenon is often referred to as “FOMO” (Fear of Missing Out), where investors get carried away by the excitement and hype surrounding a particular cryptocurrency or collectible.

The intersection of FOMO and cryptocurrencies

As cryptocurrency markets continue to fluctuate, the lines between speculation and reality are becoming increasingly blurred. The rapid price movements seen in memeCoin and other NFTs can be attributed, at least in part, to FOMO. Investors are driven by the urgency to invest in these assets before prices skyrocket.

This phenomenon has led many investors to ignore fundamental analysis and focus instead on the excitement and potential returns from investing in the cryptocurrency market. However, as with any asset class, there is always risk. Over-reliance on FOMO can lead to significant losses for those who are unprepared or do not conduct thorough research.

Another word of caution

While the rise of ERC-721 and memeCoin has been exciting for many investors, it is important to note that cryptocurrency markets are highly volatile and subject to sudden price swings. The value of these collectibles can fluctuate rapidly due to a number of factors, including market sentiment, regulatory changes, and unforeseen technological developments.

As with any investment, it is key to approach the world of cryptocurrencies with caution, thorough research, and an understanding of the underlying risks.

Conclusion

The world of cryptocurrencies and NFTs has seen a tremendous rise in recent years, driven by the rapid growth of collectibles such as Crypto and ERC-721. However, the intersection of FOMO and these markets can be dangerous. As investors, it is essential to approach these assets with a clear understanding of their risks and rewards.

This will help us separate fact from fiction and make more informed decisions about our investments in this rapidly evolving space.

Recent Posts

Tags

Quick booking process

+91 98392 24658

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.