The Role of Data Science in Cryptocurrency Regulation

The Role of Data Science in Cryptocurrency Regulation

The Role of Data Science in Cryptocurrency Regulation

As the global cryptocurrency market continues to grow, it has become increasingly important for governments and regulatory bodies to ensure that these new assets are being used responsibly. One key area where data science is playing a crucial role is in regulating cryptocurrencies.

In this article, we will explore the potential of data science in cryptocurrency regulation, including its applications, benefits, and challenges.

What is Data Science?

Data science is a field of study that combines aspects of computer science, statistics, and domain-specific knowledge to extract insights from data. In the context of cryptocurrency regulation, data science can be applied to analyze vast amounts of data related to cryptocurrency transactions, user behavior, market trends, and regulatory compliance.

Applications of Data Science in Cryptocurrency Regulation

- Risk Assessment: By analyzing patterns of suspicious activity, such as large-scale money laundering or terrorist financing, regulatory bodies can identify potential risks and take action to prevent them.

- Compliance Monitoring: Data science can be used to monitor cryptocurrency exchanges and wallets for compliance with regulations, such as anti-money laundering (AML) and know-your-customer (KYC) requirements.

- Transaction Analysis: By analyzing transaction data, regulatory bodies can identify patterns of illicit activity, such as those related to tax evasion or fraud.

- Market Trend Analysis: Data science can be used to analyze market trends and sentiment, providing insights into the overall stability and growth prospects of cryptocurrencies.

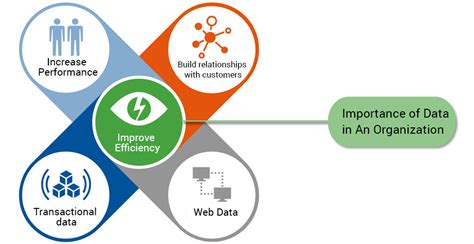

Benefits of Using Data Science in Cryptocurrency Regulation

- Improved Efficiency: By automating routine tasks, data science can free up regulatory bodies from time-consuming administrative tasks.

- Enhanced Risk Assessment: Advanced analytics and machine learning algorithms can help identify complex patterns and anomalies that may not be detectable by human analysts.

- Better Compliance: Data science can provide real-time insights into the behavior of cryptocurrency exchanges and wallets, enabling regulators to take swift action to prevent non-compliance.

- Increased Transparency: By making data more transparent and accessible, regulatory bodies can build trust with users and stakeholders.

Challenges and Limitations

- Data Quality Issues: The quality and accuracy of data from various sources (e.g., social media, public records) may be limited or inconsistent.

- Interpretation Challenges: Data scientists must interpret the results of their analyzes to identify meaningful trends and patterns.

- Regulatory Compliance: Regulators must ensure that the use of data science in cryptocurrency regulation is compliant with existing laws and regulations.

Real-World Examples

- The U.S. Treasury Department’s Cryptocurrency Regulations

: In 2020, the U.S. Treasury Department issued guidance on the regulatory treatment of cryptocurrencies, which emphasized the need for robust anti-money laundering and know-your-customer controls.

- The European Union’s Anti-Money Laundering (AML) Regulation: The EU has implemented a comprehensive AML regulation that requires cryptocurrency exchanges to implement robust risk management systems.

Conclusion

Data science has the potential to play a critical role in regulating cryptocurrencies, providing regulators with valuable insights into market trends and user behavior. While there are challenges associated with using data science in cryptocurrency regulation, the benefits of improved efficiency, enhanced risk assessment, better compliance, and increased transparency make it an important area of study.

Recent Posts

Tags

Quick booking process

+91 98392 24658

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.